Vehicle depreciation is often considered the number one expense to vehicle purchasers. Before the first oil change, a new car could lose thousands of dollars in value, potentially eliminating the down payment and equity in the event of total loss! Not only do we protect the initial down payment, but also the equity built as the loan balance falls. If a vehicle is ever totaled or stolen and not recovered at any time over the life of the loan or selected term, Depreciation Protection provides the consumer with a waiver benefit equal to the difference between MSRP or JD Power retail value at time of waiver purchase, less the amount of the loan balance at time of total loss- Not to exceed the lesser of the waiver addendum maximum or the outstanding loan balance at time of total loss.

Benefits of Coverage

Depreciation Protection

Offers protection of down payments, trade-in equity, dealer rebates, and established equity over the life of the loan or elected policy term, not to exceed 84 months

Coverage for comprehensive and collision total loss, including theft

No mileage, make, or year restriction

Claims settlements are paid directly to the loan balance, freeing up any primary insurance proceeds as cash to the borrower

60 day free look

100% open enrollment for post-closing market

Additional fee income for the lender when GAP is not a good fit for the borrower

A new product for the market that has not been served in the past

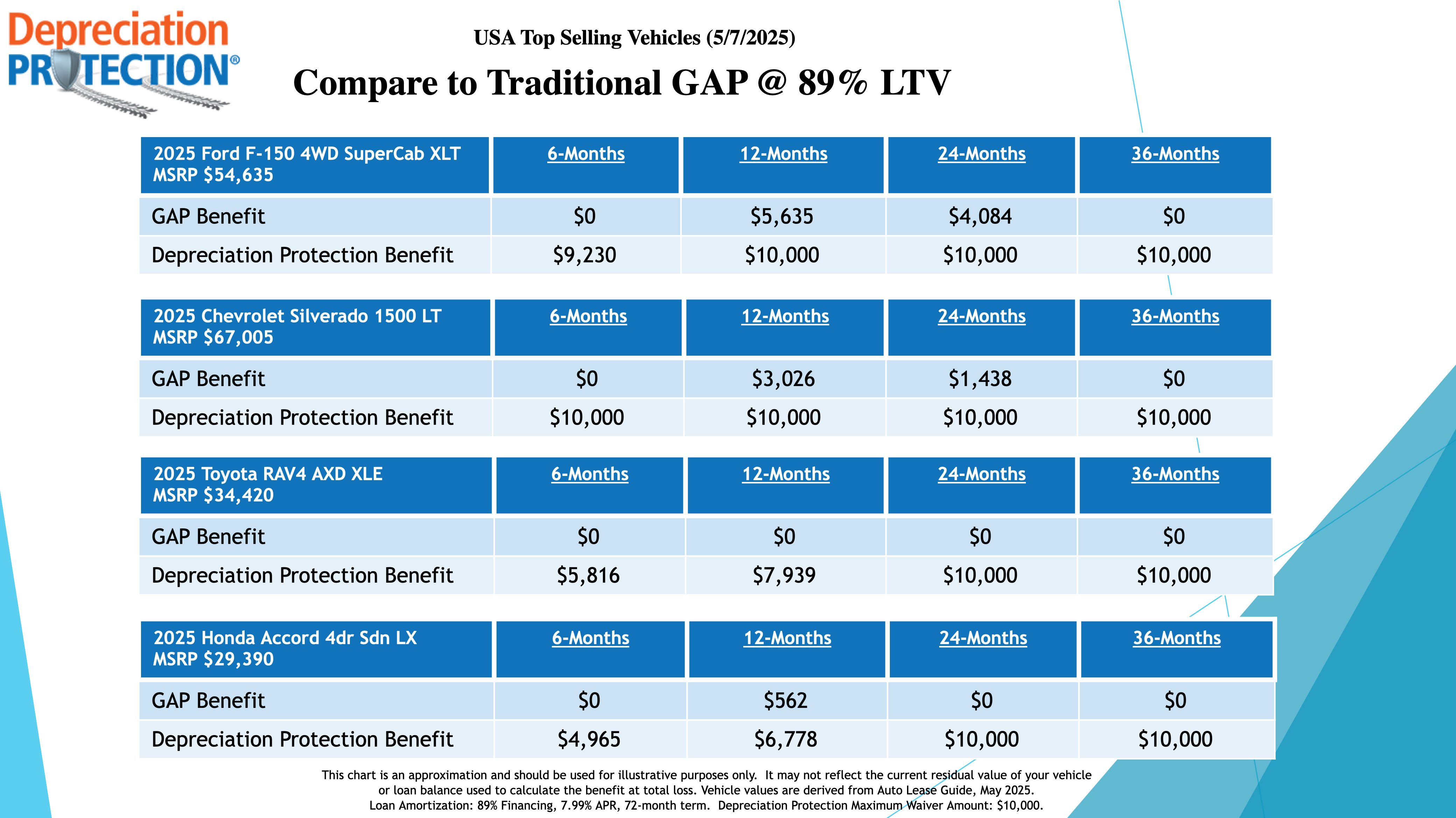

Depreciation Protection Vs. Traditional GAP at 90% LTV